I am not a farmer, but I live in Iowa so it is impossible not to care about agriculture as it is the driver of the local economy. I preface my comments by saying I know little to nothing about the business of farming. As an Iowan, I certainly hope we never have to live through another period like the Farm Depression of the 1980’s. It appears that farmers have learned their lesson according to statistics I have seen that have them taking on much less debt than the boom years before that crash. To that, I say, “Thank God.”

That said, there’s an interesting article in Barron’s titled “Harvest Time for Farming Shares.”

As anyone who has paid any attention at all knows, after an amazing multi-year run of prosperity, farming is undergoing tougher times with the prices of ag commodities down substantially in the last few years. For example, after topping out around $8.00 a bushel in 2012, the corn futures price has recently plumbed new lows in the $3.20’s. As the article states, this has potential implications for Deere (DE), Potash (POT), and Monsanto (MON). Here is the corn futures chart from Finviz.

Ethanol Demand Growth Fizzles

One of the main drivers of the corn boom of the last decade has been the increasing ethanol mandates. But, with refiners bumping up against the 10% blend wall, it is hard to see a lot of upside in demand from here.

This Fall’s expected bumper crops have driven down the price of corn, but who knows what next year’s weather holds. So the current price decline is likely overdone.

In the long term, expected growth of the world population should give farming a strong tailwind.

Extreme Valuations for West Central Indiana

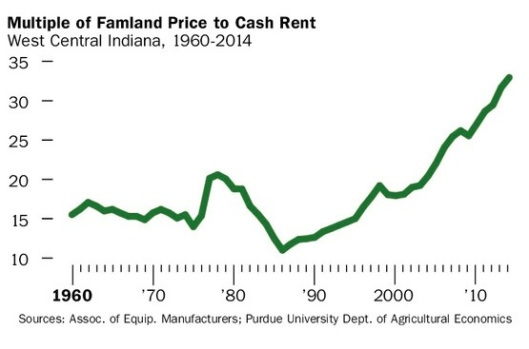

Something that would give me pause is the following chart showing the historical farmland price to cash rent ratio. As Barron’s points out, current land prices look pretty rich by that measure.

A report last month by Purdue’s Boehlje and his colleagues Timothy Baker and Michael Langemeier showed that central Indiana cropland has reached an average price that’s over 32 times the cash rent (as we show in the nearby chart), versus a 50-year average of 18 times. ‘Help us understand why you would pay today $32 for a dollar of earnings from farmland,’ Boehlje asked Barron’s, ‘when you can buy an S&P index stock for something no higher than 20?’

Farmland selling at a 77% valuation premium to its 50-year average seems hard to justify. But this data is only for Central Indiana.

What about Iowa?

By my back of the envelope calculations using data from Iowa State University’s website Ag Decision Maker, multiples in Iowa seem similarly elevated. Comparing the estimated statewide average value for “Medium Quality Farmland” of $8,076 an acre (September 2014) with their statewide average of $260 an acre cash rent (May 2014) gives a multiple of about 31.

No matter how you slice it, this seems expensive to me given rising production costs and low commodity prices.

Still, holding is fine if you are a farmer and your balance sheet lacks debt so you can handle a downturn, as your holding period may approximate forever.

Investors Beware

But, absent a substantial and rapid bounceback in commodities prices that could drive further cash rent growth I have a hard time seeing how you make farmland work as an investment from current price levels.

I see little reason to be a buyer of farmland here given fundamentals, valuation, and the potential for higher interest rates. And unless your time horizon is nearly infinite, it seems likely to be a good time to consider lightening up.