As we approach the Glasgow climate summit, it may soon be time to recover our common sense. The looney lefties have decided that an almost unlimited cost will be paid by the world’s poor (Germans pay about 300% more than the average American for power because of their green policies) in order to make a futile and stupid gesture that will have little ultimate effect on the climate circa the year 2100. This despite the fact that the poor have no extra money to spend on such folly, and would rather increase their standards of living and take care of their families than pay a pointless tithe to the gods of climate change. No matter. Evil nuclear, coal, oil, and even natural gas must be eliminated now in favor of wind and solar, potentially backed by a breakthrough battery technology that today exists only in science fiction and the five year plans of the climate commissars.

The blackouts in California, the current wind shortage in Europe, and the coal shortages across Asia that are causing soaring energy prices and factory shutdowns are a preview of coming attractions unless we recover our senses. Average people will not willingly spend huge additional amounts on energy to make the political class happy. Especially when reliability will suffer at the same time costs would skyrocket. Make no mistake: people will die from this lack of reliability when blackouts strike in the cold of winter.

But the climate authoritarians inspired by such empty vessels as Greta Thunberg will not take the blame, they will try to shift it to the utilities that are spending hundreds of billions of dollars to do their bidding, as is currently happening in California. Being an arrogant though well-intentioned leftist apparently means never having to say you are sorry, no matter how much damage you inflict on the poor in the name of trying to help them. God save us all from such “help.”

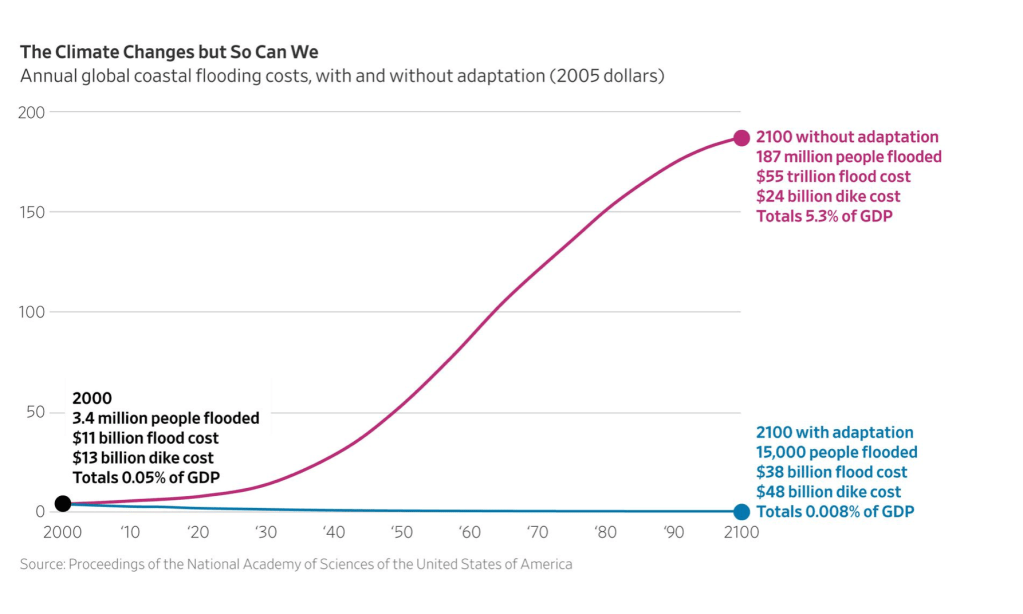

And all of the hyperventilating projections of climate disaster assume no attempts at adaptation, such as building levees as New Orleans has done. And of course, all of these sensible adaptations can be done cheaper by orders of magnitude than the pseudo-religious attempts at “abstaining” from carbon and the good life it provides for people, as Bjorn Lomborg illustrates.

Instead of adaptation, as Mark Mills shows in his article Transition to Nowhere, California is leading the charge over the cliff.

“If one were taking bets on the outcome of the race to zero carbon, odds are that consumer patience with soaring costs—in tandem with decreasing reliability—will be exhausted long before we have the opportunity to deplete the supply of critical energy minerals. Here, too, California is leading the way.” — Mark Mills

And the idea that only “the rich” will pay the bills for this climate penance is itself a double fantasy. Hopefully the mandarins in world capitals will begin to see reality, and as the scales fall from their eyes, reasonableness will return. If not, it won’t be long before the costs become clearly exorbitant and not worth the minimal benefits, at least to the people.

In the end, adults do cost/benefit analysis. If the climate agitators were serious, they would be calling for a huge increase in nuclear power that is clean, cheap, and reliable. That they are not shows their unseriousness. This unrealistic farce will end one way or another. If the left will not end it, the people will.

See also:

Climate Change Calls for Adaptation, Not Panic

California Scrambles to Find Electricity to Offset Plant Closures

To Strike a Climate Deal, Poor Nations Say They Need Trillions From Rich Ones

Energy Crisis Hobbles Biden’s Green Agenda

China’s Hypersonic Wake-Up Call

Short-seller Jim Chanos: China presents ‘a 1930s kind of problem’